What is a Transit TIF?

In 2016, the Illinois General Assembly approved a new financial tool known as Transit Tax Increment Financing or “Transit TIF.” Transit TIF is an economic development tool to support investment in large-scale, long-term transit projects. On December 14th, 2022, the Chicago City Council voted to approve a Transit TIF designation for the Red Line Extension Project via ordinance. The Transit TIF is needed in order for CTA to secure as much as $2 billion in federal funds for the much-needed rail extension south of 95th/Dan Ryan.

Such projects are typically funded by a mix of federal, state and local dollars. TIF has been used across the nation to provide a portion of the local financial commitment for transit projects. In Chicago, a Transit TIF was used to support a portion of the costs of the CTA Red Purple Modernization (RPM) Phase One project.

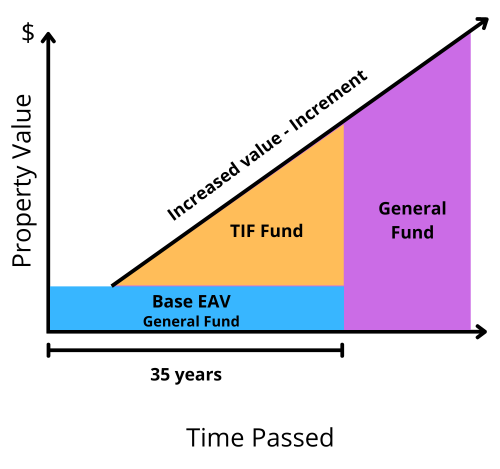

TIF is a value-capture funding source. A traditional TIF district is typically established to invest in projects that will stimulate economic development in a defined area. TIF funds are created by the growth in property value that occurs because of investment. For taxing purposes, a base equalized assessed value, or base EAV, for all properties located in the district is first established. The tax generated based on this value continues to go to the existing taxing bodies. The tax generated based on the growth in property value, known as increment, goes to the TIF district to fund projects.

To learn more about TIF in Chicago, view maps of districts, and more visit the City’s website here.

How is this taking place?

In 2016, the Illinois TIF Act was amended to allow for a new type of TIF district to fund certain local transit projects. Similar to traditional TIF, Transit TIF funds are created by growth in property value.

In 2016, the Illinois TIF Act was amended to allow for a new type of TIF district to fund certain local transit projects. Similar to traditional TIF, Transit TIF funds are created by growth in property value.

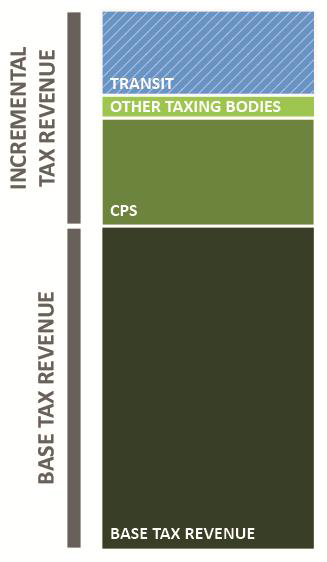

Transit TIFs are different from traditional TIFs in a few ways. Transit TIFs can be designated for 35 years, in comparison to the 23-year designation for traditional TIFs. This timing aligns more closely with financing mechanisms most commonly used for transit projects. Transit TIFs also share increment with other taxing districts, rather than using the entire incremental revenue stream to support projects within the Transit TIF district. Importantly, Chicago Public Schools (CPS) receives its entire proportional share of incremental revenues from a Transit TIF. Of the remaining non-CPS revenues, 20% are allocated to the other taxing districts, while the remaining 80% are used to fund the specific transit improvement.

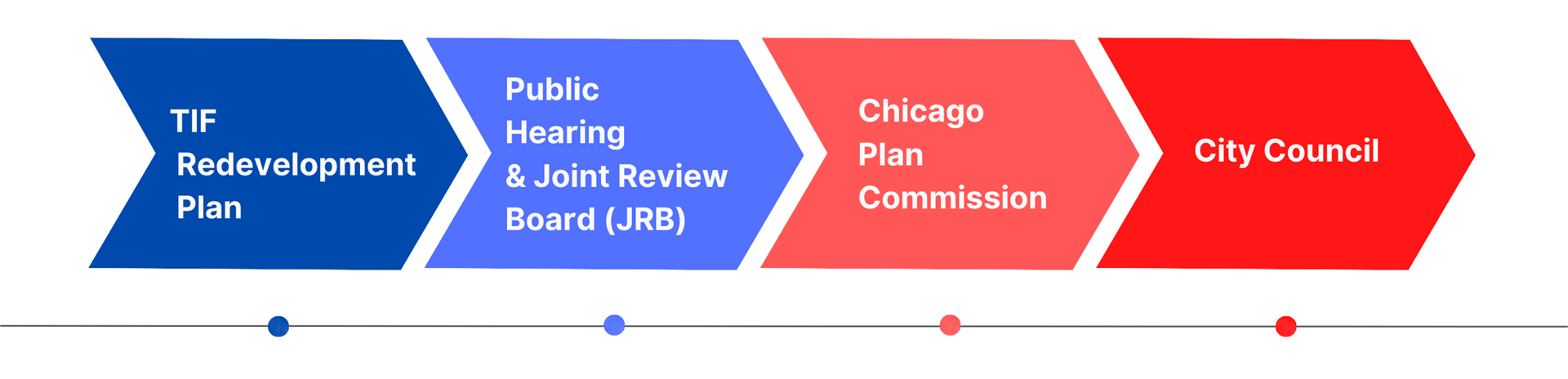

Similar to other TIF districts, establishing this Transit TIF district included a robust public process, including a Public Meeting on July 21, 2022. A TIF Redevelopment Plan was developed to determine that the use of TIF was feasible and that the Transit TIF satisfied the requirements of the TIF Act. The TIF Redevelopment Plan was then filed with the City Clerk’s Office and the Department of Planning and Development (DPD) introduced the materials to the Community Development Commission (CDC) for review. The Joint Review Board, composed of the affected taxing districts, reviewed the Plan in September 2022. Then a Public Hearing and approval vote was held by the CDC to give the public another opportunity to comment on the Plan. The CDC voted on and recommended the RLE Transit TIF to the City Council for approval on October 11, 2022. Finally, the Chicago City Council voted to approve the Transit TIF for official designation on December 14, 2022.

How will the Transit TIF be utilized for RLE?

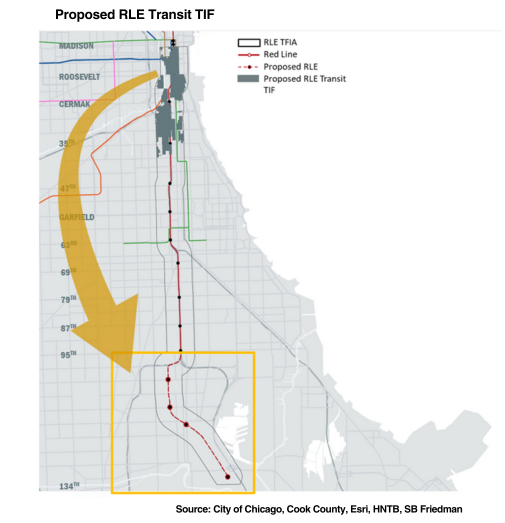

For the Red Line Extension (RLE), the Transit TIF will be used to fund a significant share of the local funding that is needed to leverage as much as $2 billion in federal funding. The RLE Transit TIF is also an Equity TIF – the first of its kind. It will leverage the success of transit-served areas in downtown and near-South Chicago to fund the RLE project and transform Far South Side neighborhoods.

According to the TIF Act, the boundary for the RLE Transit TIF can consist of parcels located within an area ½ mile to the east and west of the current and future Red Line, between Madison Street to the north and 134th Street to the south, excluding the area within existing TIF districts. These parcels do not need to be contiguous (or touching). Increment generated from the Transit TIF parcels can be spent on the eligible transit project (in this case, the Red Line Extension) within the overall area from Madison to 134th.

The RLE Transit TIF boundary (the area generating the increment) will extend from Madison Street on the north to Pershing Road on the south. View the RLE Transit TIF Redevelopment Plan for more information about the Transit TIF district and how funding will be used.

Public Meeting and Feedback

The RLE Project and proposed Transit TIF district designation were discussed at a public meeting at Harold Washington Library Center on July 21, 2022 at 5 PM. The public meeting was in-person and virtual, including a presentation by CTA and City of Chicago representatives followed by a comment period, during which members of the public asked questions and provided input on the proposed Transit TIF.

View the announcement flyer: English, Español, 普通话, 廣東話

Recordings of the Zoom webinar can be viewed here: English, Español, 普通话, 廣東話